disclaimer: all business carries risk, don't take risks you can't afford.

"Don't bring a knife to a gun fight, bring a F***ing uzi!" -John Morgan (attorney)

Zero to One by Peter Thiel - about strategy

The Lean Startup by Eric Ries

Blue Ocean Strategy by Renée Mauborgne and W. Chan Kim - about strategy

Never Eat Alone by Keith Ferrazzi - about networking

The 4-Hour Workweek by Tim Ferriss - about efficiency and balancing business and enjoying life

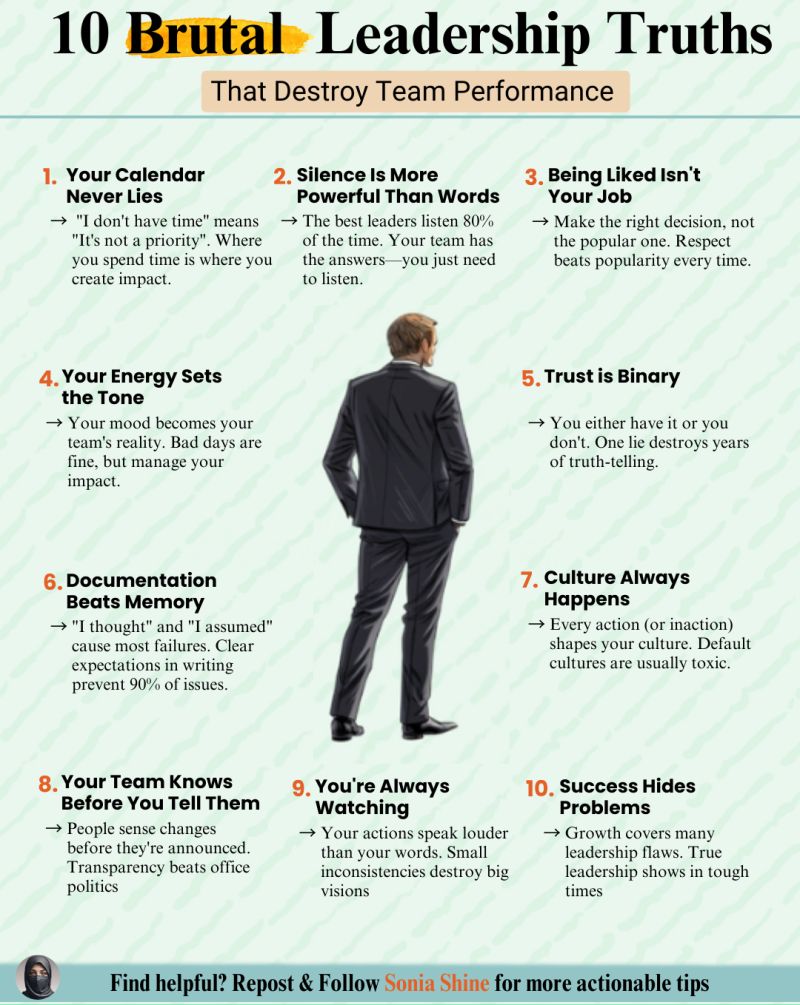

Multipliers by Greg McKeown and Liz Wiseman - about leadership

Team of Teams by General Stanley McChrystal - about organizational behavior

The Art of the Deal by Donald Trump

Karmic Management by Geshe Micheal Roach et al

Unscripted by MJ DeMarco

This video shows the downside of being self employed or owning your own business before it gets big enough.

Ah yes, the good stuff! I’m one of the few who encourage entrepreneurship while also supporting finishing college. Most well-paying jobs require a degree, and it’s tough to fund a business on a shoestring budget with low income if you can’t find investors. The good news is that successful entrepreneurs come from all backgrounds—some excelled in school, while others didn’t. A meme circulated claiming that school performance didn’t matter for success, featuring Bill Gates, Jeff Bezos, and Elon Musk—but Gates went to Harvard, Bezos to Princeton, and Musk to Wharton. All prestigious schools.

The founder of Quest Nutrition told his customers to request his product at their local retailers, the customers would do it; they'd tell retailers they weren't interested. The end result, when they finally were interested in retail; they had a lot more leverage and maintained decent margins.

Alex Hormozi "ask yourself: does this get me closer to my goal, does this increase my odds of success better than doing so on my own and can I afford it. If you say no to any of those, don't do the deal."

You may want to join a mastermind or hire a startup coach.

Attending a prestigious school can be beneficial if it's affordable, even if only part-time while building a business. If not, community college works as long as it's accredited. A bachelor’s degree is typically the best path.

The Trump administration removed the deduction for entertainment expenses, which is one policy I disagree with. Entertaining clients is a legitimate business expense, and hopefully, this will be corrected in the future.

If you need a C Corp (best choice for a business to sell, raise capital via crowd-investing platform, needed to benefit from QSBS and inventory deductions allowed with cash accounting under 'big beautiful bill') then a Delaware corp allows 1 person C-corp's; cutting down on red tape and jumping through hoops. If you have multiple investors who want board seats, then a Delaware corp may not be needed; just pointing out one reason it's worth considering.

Three things to know to enhance business ability: NL Texas Holdem Poker, golf & a foreign language (Spanish is the most spoken US 2nd language, German, Mandarin, Farsi, Japanese are all good choices as well; most of the world has large English speaking populations so if you don't speak English you should learn it especially if in an English speaking country.) A lot of business is conducted over the golf course and with people you meet in golf and poker; and even if they speak English they may appreciate that you know some of their language.

Owning a business has perks like writing off a new vehicle over 6,000 lbs, corporate jets, and even tax-free long-term capital gains on the first $10 million invested into private equity. Puerto Rico also offers major tax advantages, requiring a $10,000 annual charity donation, six months of residency per year, and homeownership within two years.

When I finished my MBA in Finance, I realized a business should be built for **scalability and resale value**, not just short-term profits. Keeping expenses low is crucial—imagine if you had $200K in earnings but paid yourself a $50K salary you didn’t need. When selling, that could cost you $1 million.

Some criticize the idea of selling a business, but most S&P 500 companies don’t last 20 years. If someone offers 10–20 years of profits at once, with a **20% tax rate**, it’s worth considering. You can reinvest, start another business, or take a break. A larger company may have better resources to scale, reducing costs and expanding market reach more efficiently than you could.

This video goes over one of the odd quirks of building a business to sell, it's not always the case; but he makes a good point. Viewer discretion advised, some language.

People have turned a few hundred dollars into millions flipping sneakers, but if I tried that, I’d lose my shirt!

Integrity is non-negotiable. If you lie to me once, we’re done. Trust builds long-term relationships.

“Loyalty is a two-way street. If I’m asking for it from you, you’re getting it from me.” —Harvey Specter (*Suits*)

“I hate a liar more than a thief. A thief is after my salary; a liar is after my reality.” —Curtis Jackson (50 Cent)

Ensure sufficient funding before starting. If a business will cost $250K–$1M, assume $1M is required. Avoid funding through personal credit cards.

Surround yourself with capable people. Recently, I met high school students excelling in management, media production, and entrepreneurship. These individuals could grow into trusted advisors or executives.

SBA loans are an option, but interest payments add capital expenditures. Equity funding may be better, even if it means sharing ownership. **Better to build wealth as a team than fail alone.**

Section 1202 is a **$2M tax-free gift**. If you invest in a company under $50M in assets and hold for 5+ years, capital gains (up to $10M) are excluded from taxes.

Even better—you can use this exclusion **multiple times** per year. Invest $1M annually in startups, hold for five years, and cash out $10M per business, **all tax-free**.

Alex Hormozi's Acquisition.com buys $1M of a $10M business and scales it to $100M. If he does this 10+ times annually, that’s a **tax-free path to a billion dollars.**

By relocating to Puerto Rico for **184+ days per year**, donating $10K annually, and owning a home within two years, you can **reduce tax rates to just 4%** until 2035.

your business and other peoples money (raising capital), your business and your money (bootstrapping), other people's business and your money (investing), other people's business and other people's money (running a fund.)

Buying businesses-You might find a self service car wash for $700k with $100k down that makes a profit of $100k/yr, in a year you've covered your cost (though you have to make sure that $100k profit includes debt service on that 600k loan, if it's less; you have to look at the numbers and make sure it makes sense.) In a scenario where after tax profit is $100k, in a year you buy a second car wash, a year later you might buy 2 car washes; or diversify into other businesses. Some businesses that make $100k annually in profit sell for $300k with no real estate, the reason being that the owner no longer wants to run it and if they close down they get nothing. You might get them to stick around for 2 years and train the manager for $50k a year on top of a $300k note they agree to. You can google 'Business broker' and google will often find business brokers in your state or city that often list all of the businesses (along with revenue, profit if any, type of business); within a few minutes I found laundromats PMB business, roofers with profits (the first 2 were under $40k for a money losing business, if it's a good location it might work for a turnaround expert.)

Investing in local businesses If you can invest in a business that is designed to start throwing off cash right away, with high probability; that can be a good early opportunity. If you had $100k and can buy 10% of a business for $10k, if that investment looks like it will throw off $1k/mo in cash it might be worth it if it's a high probability; but I wouldn't stake a lot into it. Once you're wealthy, private investments offer a great opportunity as dividends are taxed favorably and if the company is sold you get the QBTE and don't have taxes on the first $10 million in qualified long term capital gains for a company you held at least 5 years that follows a few other rules. But, early on; cashflow and high profit margins are key.

A Navy Seal discusses the meaning of mission statements and vision statements better than any MBA program, due to the nature of military service; the language can get a bit graphic- viewer discretion advised.

Machiavelli warned that leaders must either be kind from the start or firm from day one. Flip-flopping leads to failure. Kindness works best for competent employees, while underperformance may require a stricter approach.

Maslow’s hierarchy of needs can help managers understand employees’ motivations. Recognizing where someone struggles—security, belonging, or self-actualization—allows tailored support. Great bosses balance **firm leadership** with **inspiring motivation**.